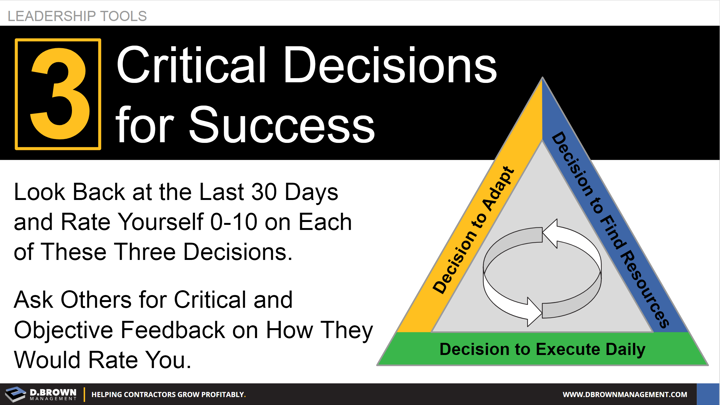

1.The Decision to Adapt:

Do you have a clear vision of the skills and behaviors you need to demonstrate to be successful in the role you want (or need) to have five years from now?

Have you truly made the decision in your mind that you need to build yourself?

Hint - Writing this down in very specific and quantifiable language with timelines can be huge.

2.The Decision to Find Resources

Have you tenaciously sought out the resources that can help you build yourself? These resources include meeting the right people, joining the right groups, finding the right training, books, websites, etc.

Hint - think about your first “low-bar” as having 50 conversations with people who are successful and closely associated with the role you want to build yourself into.

3.The Decision to Execute DAILY

Have you laid out and stuck with a rigorous professional development program?

Hint - this is as regular and committed as a routine you would use to train for a triathlon. Most successful people just simply train harder, train longer and are willing to fail more while continuing forward with a positive attitude.