Business development is crucial for any contractor to grow sustainably. This starts with choosing the best market strategy for your company at this point in time.

Assuming your operations are at least on-par with your competition:

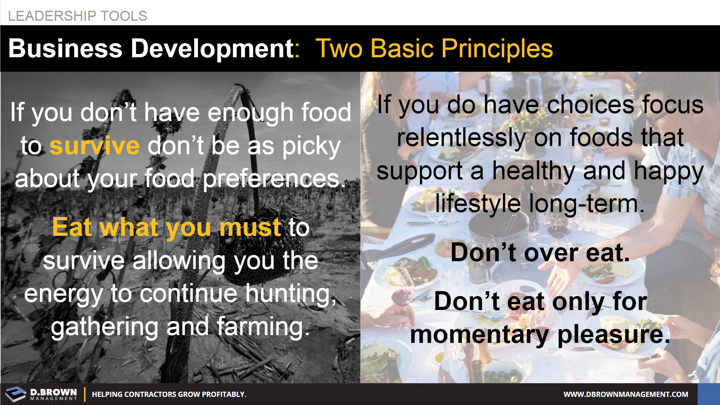

If your profitability is marginal or even at a loss due to too little work, then your market strategy and business development tactics must be aggressive.

If your village had too little food, you would double-down on your hunting and gathering efforts. You would get up earlier and stay out later. You would explore further out from your village.

And you would remember to not eat poisonous plants or bad meat even if you are hungry, because that would make the situation worse.

Gradually, you would gather enough strength from this extra effort and food to invest in longer-range farming activities.

If your profitability is solid, you can get more selective and strategic about the work you take on.

It is the same with food. Eat what will sustain you in the long-term and makes you happy.

Invest more in farming operations and more away from hunting, but don’t lose those skills.

Don’t overeat. Don’t over hunt, fish, or farm. Don’t simply eat for short-term pleasure.