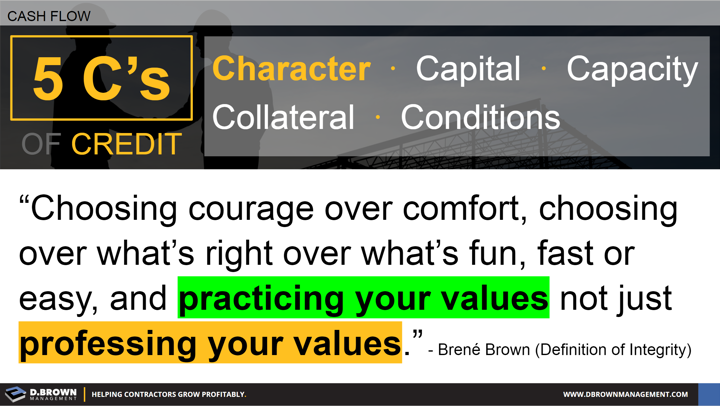

Out of the 5C’s of Credit, character is the one that takes the longest to develop and can be lost in an instant.

Character is like your safety EMR in that it is a multiplier for the other C’s, including how much capital you will have to put into the deal, what collateral you will have to put at risk, how much you can leverage your capacity, and how stringent the conditions will be.

Character also impacts every other aspect of your business, ultimately enhancing your ability to grow sustainably. Contractors with owners and management teams that have strong character will experience improvements to the following:

- Attracting and retaining the best team members.

- Repeat customers.

- Customer willingness to negotiate contract terms, including payment schedules and bonding requirements.

- Vendors and subcontractors willingness to do the same.

- Banks, sureties, and insurance companies underwriting the businesses growth.

The opposite will lead to problems in these areas.

Character is built up over time through many hundreds of small interactions, just as Brene Brown describes around building trust. Start building relationships early with your financial partners and others. Continue building them by being consistent with communication. Be conservative and transparent with news, both good and bad.

“The culture of any organization is shaped by the worst behavior the leader is willing to tolerate.”

- Rick Lochner