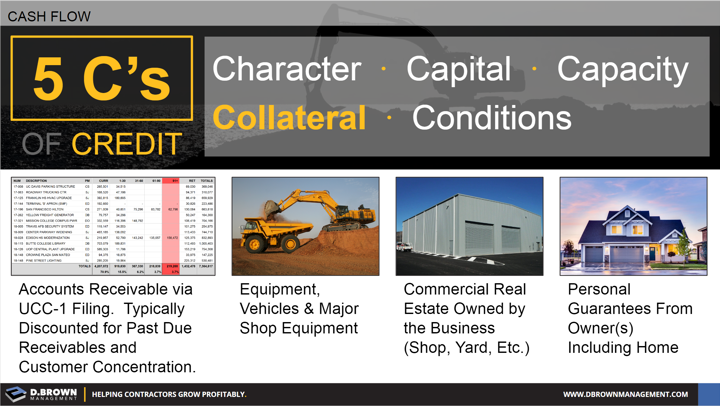

The 4th of the 5Cs of Credit is how much and what type of collateral the contractor will put up as a guarantee.

When the underwriting requirements are relatively small, this is often done like a personal credit card. Very quickly, however, the collateral requirements will increase.

For specific purpose financing, such as for a piece of equipment, building, or land, the collateral is often just the title for what is being financed. The amount of capital or down payment that is put into the deal is what the contractor puts at risk.

For an Operating Line-of-Credit (LOC), a bank may ask for some or all of the following with differing conditions:

- Rights to directly collect on your Accounts Receivable (AR) via a UCC-1 filing. The value of your AR as collateral is often a discount in the 80% range, excluding past-due receivables and single customer concentrations over 20%.

- Second position behind any specific financing on fixed assets, including vehicles, equipment, and real estate.

- Personal guarantees from the owner(s) of the construction business.

Sureties and other underwriters will look at some combination of this collateral and may want to place themselves in a position ahead of the bank in specific circumstances.

Collateral is often a challenge during succession plans as risk is being transferred.