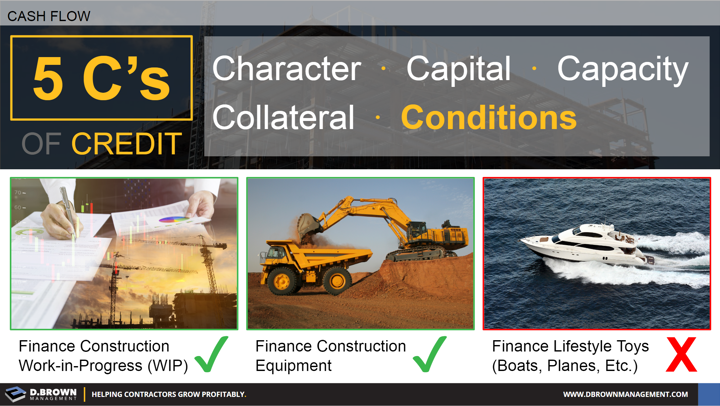

The 5th of the 5Cs of Credit are the conditions for the loan, which is primarily what the funds will be used for. These conditions are here to protect the contractor as much as they are there to protect the bank.

- The Operating Line-of-Credit (LOC) is there to finance your construction Work-in-Progress (WIP). All of the covenants for your LOC, including collateral, capacity, and capital are based upon it being used for this purpose. If it is used for anything else, you are adding unnecessary risk.

- Over Billings must be treated exactly the same as your LOC because they are essentially very short-term loans from your customers. If those funds are used for anything besides simply building the work and using less of your bank LOC, then you will get into trouble quickly.

- Financing for vehicles and construction equipment should be tied to that piece of equipment for collateral. More importantly, you need to do some solid projections to ensure that you really need that piece of equipment to run your business today and over the next few years. Having debt tied to equipment that is not being utilized can kill a contractor in a downturn.

- For larger bonds, your surety will look deeply at the project with you and make a determination of your ability to execute. Bonds are project specific.

NEVER take on a dollar of debt unless you can clearly see how it will make you more money in the future. As owners, we are all optimistic, but if we can’t convince our financial partners to take some risk with us then we should deeply rethink that risk ourselves.