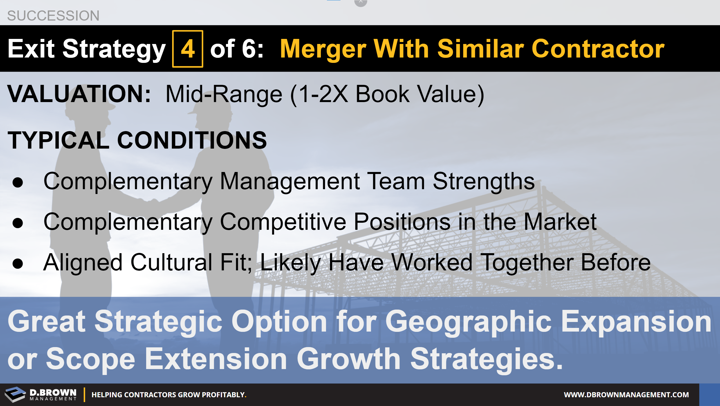

The valuation of this type of deal is less than a strategic sale to an outside buyer, where the buyer is looking for rapid scalability to get their return on a high valuation.

In this type of a merger, there might be some modest operating synergies and growth opportunities, but for the most part, the business is expected to continue to perform as it has been.

Achieving these synergies requires complementary management teams and aligned cultures. Preferably, this has been tested before the deal through working together on a few projects.

The most important financial dynamics to analyze in this type of deal are:

- What will be the combined financial strength of the two contractors? Stretching too far will endanger the owners of both.

- Don’t overestimate the operating synergies or growth that will be achieved in the deal.

The major upside for the owner(s) that are exiting is the security and the stability of the combined operations as they will most likely be getting their capital out over time depending on the structure of the deal.