The leadership teams of contractors must constantly assess where the business is at in the growth cycle and whether their current strategy, structure, talent and management processes are ready for the next stage of growth.

As a business is growing; especially with a strong leader in place it is easy to become what we call a hollow contractor. A hollow contractor typically has performed extremely well in some years.

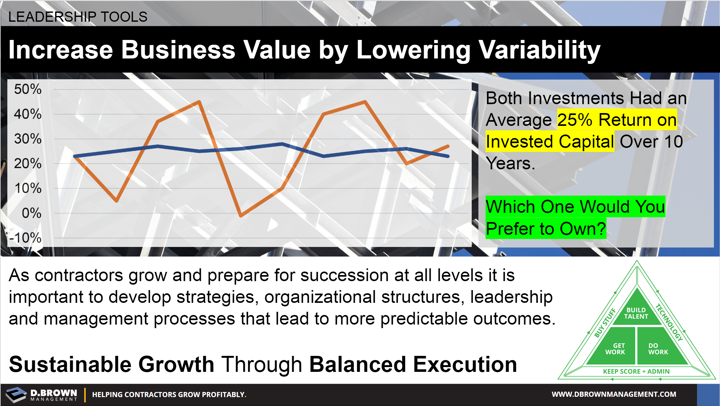

What they are typically missing is a depth of talent at all levels supported by scalable processes and training that enables sustainable growth.

- Get your market strategy right ensuring consistency through various economic cycles.

- Set up your organizational structure to support this market strategy. Focus on the roles and capabilities that are necessary; not the people.

- Know where your talent gaps are in both bodies and capabilities.

- Aggressively fill those gaps through training, recruiting and when necessary by terminating.

Only after this foundation is well under way should you focus on the next steps.