These transitions impact many people, especially the owners and the management teams.

Valuation is a very critical factor during these transitions because it has to be a number that fairly represents the value of the business for the outgoing owners while providing a solid return for the buyers.

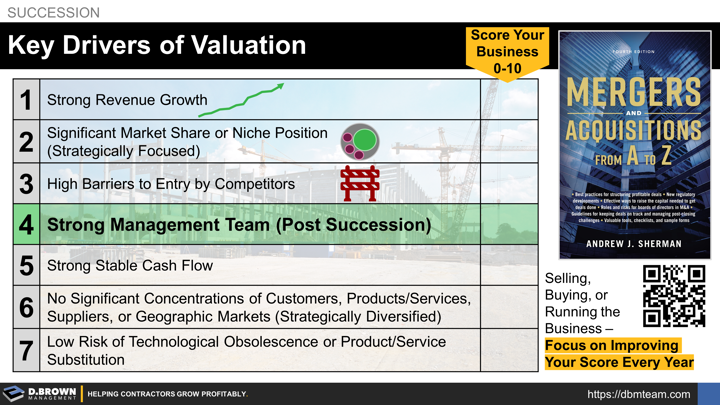

Andrew J. Sherman just published the Fourth Edition of Mergers & Acquisitions which should be read by anyone who is or could potentially be on either side of a transaction.

He laid out 7 Valuation Drivers:

- Strong Revenue Growth

- Significant Market Share or Niche Position

- Barriers to Entry by Competitors

- Strong Management Team

- Strong Stable Cash Flow

- No Significant Concentrations in Customers, Products, Suppliers, or Geographic Markets

- Low Risk of Technological Obsolescence or Product Substitution

While some - like 3 and 7 - may not seem like they apply to contractors, there are many contractors out there that have created these advantages and it all starts with vision and strategic choices followed by years of deliberate execution.

Number 4: Building a strong management team is the leverage point that makes the other factors sustainable in the long-run and, therefore, truly valuable.

Exercise:

Have your management team members rank your business (0-10) on each of the above factors, giving the primary reason for their answer on each.

Have them identify the contractor they know is the best at each of these factors and the primary reason for their answer.

Share what you are learning with each other using the 5D process for alignment.