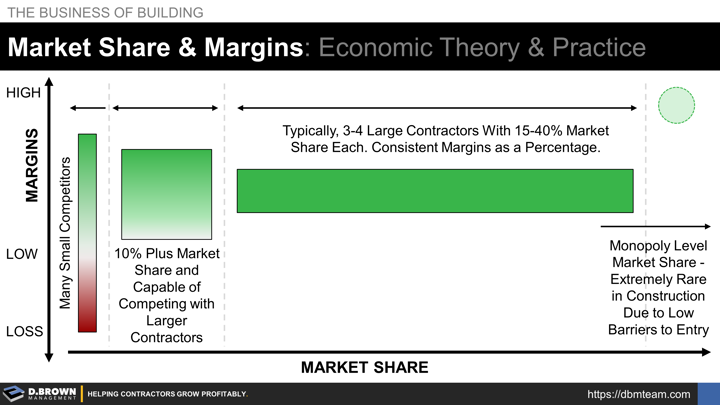

Learn why margins are difficult to achieve when entering a market, how to reach the optimal 25-30% market share while stabilizing your margins, and why margins begin to erode beyond that range—unless a monopoly-level market share is achieved, which is very rare for construction contractors.

Understanding these dynamics will bring clarity to your strategic decisions, planning, and execution.

Basic Vocabulary of Economics (Market Types)

- Monopolistic: A market structure where a single dominant player can heavily influence or even dictate pricing to both customers and suppliers. This is extremely rare in construction due to the relatively low barriers to entry.

- Oligopolistic: A market structure where small number of contractors dominate the market, influencing prices, and being interdependent on each other's actions, though without colluding.

- Perfectly Competitive: A market where many small contractors compete, and none can influence prices individually. Wide variations in information and capabilities create significant differences in both pricing and margins, with the overall trend being lower prices (to the customer) and, therefore, lower margins.

These market conditions are constantly changing. For practical purposes, the markets that most contractors compete in are a combination of perfectly competitive and oligopolistic.

Monopolies in Construction (Very Long-Term View)

The term "Monopoly" can apply to contractors of any size if the definition of a market is sufficiently narrow. We'll use the concepts of Niche Market and Differentiation to describe these scenarios, as they are relevant to success for contractors at all stages of growth.

One dynamic that we can expect to see more of in the construction industry is large Private Equity and Venture Capital firms backing entrepreneurs with strategies and plans to consolidate. Though this activity has been going on for a while, we are still in the relatively early stages. You can see this most clearly within the supply chain where contractors have fewer and fewer choices when it comes to purchasing certain materials.

There will be more of this activity over the next decade as large amounts of capital will flow into the market continuing to consolidate contractors and the supply chain while working to streamline the entire construction workflow through standardization and manufacturing. Remember that it is a $2 trillion dollar industry just in the US.

Many of these investments will end in some degree of failure. However, all will disrupt the markets they compete in. A few will succeed, and that will dramatically change the landscape for all contractors.

Think about how much Uber disrupted taxi companies by essentially subsidizing the cost-per-ride by about $1 billion dollars per quarter. Whether Uber survives or not isn't relevant in the long-term. What matters is that an entire industry was disrupted. Future competitors won't look anything like the taxi companies that dominated the market for decades.

Also, recognize that while antitrust laws are intended to prevent monopolies from harming markets, the opposing force is capitalism, which drives companies and investment toward monopolies. It is a balance.

While construction is significantly more complicated, we can't dismiss the fact that some will continue to attempt this, and that will impact every contractor. It is something to continue to watch and prepare for over the long-term.

Oligopolistic Markets - A Little More Detail

While the word is a mouthful, that is the term. We didn't pick it. :)

In this type of a market, each of a few competitors has 15-40% market share. Because of their size and the movement of management resources between companies, they are very aware of what each other are doing. Their size also comes with higher levels of fixed costs and organizational momentum, so they can't afford to lose market share.

If one competitor raises prices (to the customer) and therefore margins, the others will stay where they are, so that competitor will lose market share. There is little incentive to do this. Conversely, if one lowers prices, the others must follow quickly to avoid losing market share, so it becomes a race to the bottom—also no incentive to do this. At this level, operations are relatively consistent across the competitors and there are incentives to keep pricing and therefore margins stable.

Considering that these few contractors perform the majority of the work by dollar volume in a given market sector, their margins may be less than some of the smaller, more nimble contractors (see below), but in total dollars, they are also making the majority of the margin.

There is a huge chasm between a contractor being in this group and emerging as the single dominant competitor (monopoly).

There is just as big of a chasm between being one of many contractors competing for the smaller projects and moving into this higher-level position with limited competition. We'll explore that further below, including the steps required to get there.

Building the Foundation (Step 1)

For practical decision making, most market sectors are a combination of perfectly competitive for the smaller projects and oligopolistic for the larger projects, typically with 3-4 large contractors dominating those larger projects.

Those smaller projects are typically built by contractors in their first three stages of growth. Some of them have built the combination of:

- Niche "Submarkets" within the larger market sector so they can create a "Mini-Monopoly."

- Clear ways to differentiate themselves from their competitors in a way that matters to their customers.

- Operational excellence in their execution, with consistency from estimating through operations. This is why we call Stage 3 the "Refinement" stage.

All contractors start at this stage of the market.

For the contractors that are able to achieve all three of the above, they will see bottom-line performance 2-3X industry benchmarks. This higher level of profitability typically represents less than 10% of the total market sector.

Depending on the business objectives, staying in this range may be the plan which is perfect, as this foundation must be achieved before moving to the next phase of a growth strategy.

Contractors who have not yet built this foundation will find themselves in a very competitive market for every project, driving down margins. Those without operational excellence in estimating and delivering projects consistently will experience a wide range of margin outcomes, including losses.

Your Next Move (Step 2)

Moving to the next stage of growth in a market. and as a contractor, requires:

- Maintaining the existing capability and reputation for delivering on these smaller projects.

- Investing in capabilities required to compete on some of the projects that the large contractors handle. Examples of these investments may include engineering and preconstruction capabilities, virtual construction, prefab/manufacturing, and improved business development capabilities around RFP responses and interviews. These investments often align with the inflection points of growth that every contractor goes through.

- Investing in capacity including your own workforce (including subcontractors), project management teams, field leadership, equipment, and financial strength (capital, surety, credit) required for these larger projects.

Build Your Reputation (Step 3)

Step 2 takes time, with both new capabilities and capacity requiring time to build. Those investments must be funded by the foundation you built in Step 1.

Now it's time to start looking at some of the projects that would typically only be built by the largest few contractors in that market. It may take you a year or more to land your first one and start building it. Remember, your reputation will be based solely on the performance of this project. Any hiccups will make it even more difficult to even be invited to look at the next project. This is why discipline in Step 2 is critical—don't overextend.

Remember the balance of confidence and competence required for success.

When Is Step 4 Required?

The fourth step is required when you are now comfortably positioned as one of the largest contractors in the market. Your market share is consistently in the 25-30% range. Growth beyond that in that market sector will typically lead to cannibalization of your margins. Customers will make it difficult for you to grow past this range, as you will start to represent supply chain risk for them.

Keep in mind that this percentage of market share will have several different levels.

- Customer-Level: If there is someone like a CM/GC between you and the project owner.

- Project Owner Level: If your customer is not directly the project owner.

- Geographical Area

- Market Sector (Industrial Classification)

Your strategy and plan should be to work through each level systematically.

We would typically consider "Step 4" when you have achieved this level of market share within a market sector and geographical area. At this point, you have some additional strategic decisions to make about whether you:

- Stay where you are, as the project owners and market sector in your existing geography(s) are growing fast enough to meet your business objectives.

- Expand to additional scopes of work.

- Expand to other market sectors.

- Expand geographic areas within that same market sector and scope.

Or some combination of the above.