Tax Savings means that for a given amount of business activity in a year, the total taxes due are less if you choose one method over another.

For example, if your objective is after-tax cash from the business into the hands of owners, then a pass-through entity structure will typically save 10% or more in taxes depending on the state you are in.

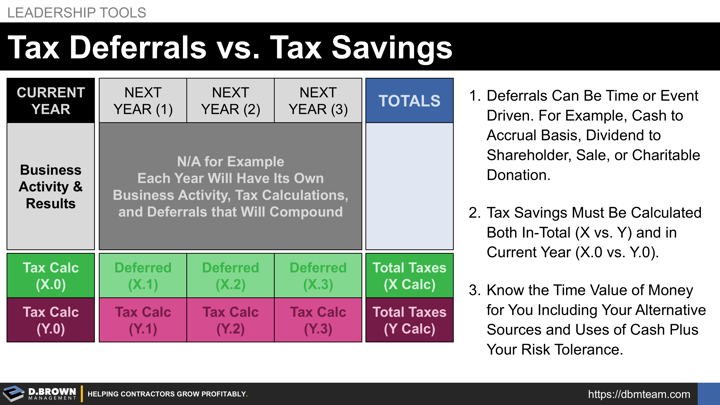

Tax Deferral means that for a given amount of business activity in a year, the total taxes due that year are less but more taxes will be due in the future.

For example, if you are under a size limit where you can calculate taxes on a cash basis, and manage that correctly, you can typically pay less in taxes in the current year than if you were on an accrual basis with percentage of completion method required for your projects. However, if you are growing, you will get to a point where you have to file on an accrual and percentage of completion basis. At that time, the rest of the taxes will come due, though the IRS will give you several years to pay them off.

Disclaimer: We are not CPAs or tax attorneys, and this is not meant to be specific tax advice. This is meant to be foundational knowledge only that can help you select and work with the best financial partners for your current stage of growth and growth trajectory.

Deferrals can be time or event driven such as the example of cash to accrual basis given above, a distribution or dividend to a shareholder, sale, or charitable donation.

Tax savings must be calculated for both the current year, which impacts immediate cash flow, and over time, considering the total taxes likely to be incurred. For a deeper understanding of tax strategy, planning, and management -- including key variables, risks, and probabilities -- refer to The 4 Critical Aspects of Taxes.

Know the time value of money for you, including your alternative sources and uses of cash plus your risk tolerance. Everyone is completely different in how they approach this.

Remember that both what is deferred and the payments for deferrals will compound with each year of business operations. If you are only looking at the summary tax returns each year, this can cause some confusion. Start by modeling a single year so you deeply understand the relationship of business activity and results, and the taxes associated with that over time. Then model a second, then a third, fourth, and fifth, seeing how they layer on top of each other.

Make sure that you have a clearly understood model and plan to execute a strategy over the long term. For example, shareholder loans can be a way to put cash in your pocket today. Know what your plan is to clear those up and what the total cost will be over time, including interest and taxes. We have seen multiple examples where advice is given at one point in time and either the person who gave the advice retires before execution is required, the tax code(s) change, or both. Making sure you have an understanding of the fundamentals will protect you against this.

We have seen the best long-term results for contractors come from being:

- Intentional about their strategic choices.

- Aggressive in their business development and talent development.

- Deliberate with their operational planning and execution.

- Conservative with their financial management and reporting.

With that in mind, we always recommend:

- Accounting for depreciation in alignment with usable life and Fair Market Value (FMV) as compared to accelerated depreciation for tax purposes. Fully leverage tax savings, but ensure they are accounted for differently internally. Your internal financials must model your business operations. Timing on tax payments impacts the cash flow which is also important to model.

- Accounting for all projects exceeding 30 days in duration or over $25K in value using an earned revenue calculation method that more accurately reflects actual business dynamics, rather than relying on bills, costs, or cash flow.

- Deciding on the best balance tax savings and deferrals as identified above.

- Accounting for those tax deferrals clearly and conservatively, at least on internal financials, so you see the real impact on retained earnings, equity, and working capital as incurred.

This can take several forms including some "Below-the-Line" calculations for Tangible Net Worth (TNW) from the perspective of the shareholders as compared to book value as stated by various accounting standards.

With our engagement model focused on long-term outcomes, we see these play out in many ways, especially during succession. Too frequently, the results are negative surprises, much like a project going over schedule and over budget. There are no perfect answers that we've found. With that said, we will freely share anything we've learned that will help you build a stronger business and "Retirement Masterpiece."

Please contact us to talk specifically about your situation.