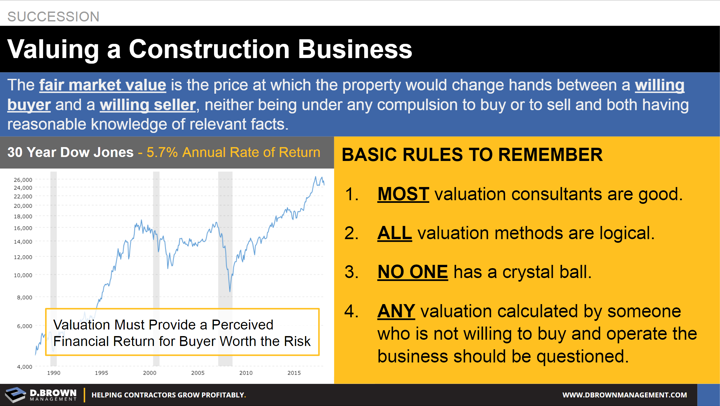

Keep in mind that the definition of “Fair Market Value” is quite simply what a willing seller and buyer agree to, with both having reasonable knowledge of relevant facts and neither being compelled.

To simplify: all valuation methods try to predict the future performance of the business because this is what ultimately provides the financial returns for all parties. All methods come down to some form of Discounted Cash Flow and the Net Present Value of that cash flow.

- Unless the contractor has a strong base of recurring service and special project work or some other “lock” on customers, looking at historical performance may not be the best predictor of future performance.

- If the seller is not preparing for an ownership transition well in advance, they will be under time pressure and therefore “compelled,” lowering the valuation.

- In a strategic sale, there is some aspect of the business that the buyer will be heavily leveraging that can significantly change the valuation. These are the rarer cases but heavily skew overall valuation perceptions.

- Focusing on the gross sale price instead of the net income versus time and risks for the seller based on different exit strategies.

Just know that investing capital in a construction business must provide a substantially better return than investing in a more liquid investment like the stock market.