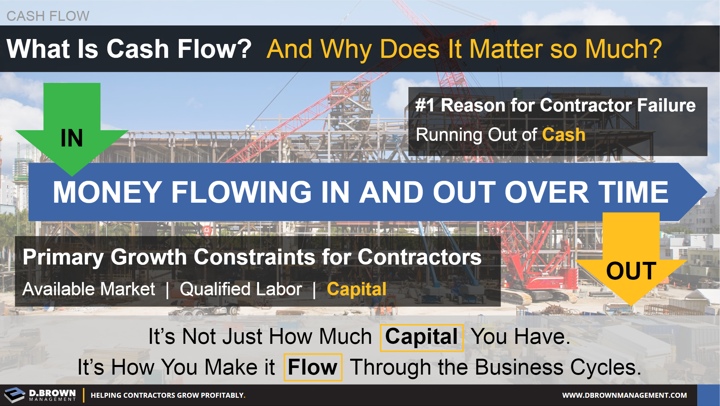

This is how capital (cash) flows in and out of the business over time. Poor cash flow is a primary reason for contractors failing or their profitable growth being seriously constrained.

When we looked at the basics of project profitability and compared it to a paycheck of $1,000 per week we saw that we only had $50 per week for taxes, savings, unexpected expenses and discretionary spending. For a contractor discretionary spending includes things like investment in new tools, equipment and technologies.

We all know the pressures of managing a household budget that was that tight. We were thankful for the weeks of overtime and dreaded the weeks with rain or no work.

- How much more money would you have to have saved if you got paid monthly instead of weekly?

- What if it were every 45, 60 or even 90 days like many contractors?

- What if 10% of your gross income ($100 per week) were held back from your payment for a year or more? That’s retention!

Remember that a contracting business has three major constraints to growth. Sustainable growth is about systematically removing each of those constraints:

- Available Market - Getting quality work

- Qualified Labor in a tight market

- Capital - Essentially the “savings” required because cash flow follows profitability