You don't have to be tax expert to build a construction business. As an owner, you must take the time to understand the basics because you are the decision maker and ultimately accountable for the outcomes of those decisions.

Too frequently, decisions made in the short-term don't work out as planned in the longer term. This can include excess taxes being paid or surprises down the road when deferred taxes come due.

Disclaimer: We are not CPAs or tax attorneys, and this is not meant to be specific tax advice. This is meant to be foundational knowledge only that can help you select and work with the best financial partners for your current stage of growth and growth trajectory.

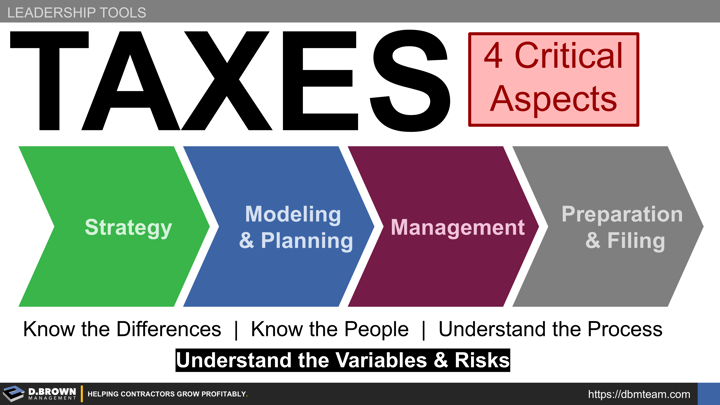

The Four Critical Aspects Are:

- Strategy: These are the broad and directional decisions that you make about taxes with a lot of them being dependent on what you want to do with the business and earnings from the business long-term. For example, do you plan to retain it in a family trust, sell it, donate proceeds to charity, maximize after-tax cash flow to shareholders each year, etc.?

- Modeling & Planning: Similar to, and integrated with your business model and business planning, this takes your strategy and puts it together with some simple variables and assumptions over time. At this level, focus on the 3-5 biggest drivers of the taxes and some simple average rates to use. If you are modeling for 5+ years out, test your model for some pretty wide ranges in outcomes. Some models that look fantastic for X level of earnings prove to be very tax inefficient for 3X that level. Over the longer term, we've seen many contractors achieve way more than they thought possible.

- Management: As with building projects, this is where the rubber starts to meet the road. This is about the hundreds of smaller decisions made every day, especially at the end of the year that will keep your plan on track. These range from how much cash to keep on hand to the timing of capital purchases to the timing of shareholder distributions or dividends. No amount of planning matters if the execution is poor.

- Preparation & Filing: This is the final stage and the one that gets a lot of attention. It is often like the last 10% of a project where everyone is running around, stacked on top of each other, and working overtime. Those "heroic" efforts are too often rewarded just like they are when building projects. This aspect is absolutely critical but like the final stages of preconstruction, there is only so much that can be done at this point. Results can nearly always be improved with less cost and stress if some of the resources spent here were shifted to strategy, modeling, planning, and management.

Know the People:

- There is no single person that knows every aspect along with your business.

- The person(s) who are the expert at each of these aspects inside and outside your business are all equally valuable to the process, but they are not the same and must be integrated to achieve the outcomes you want.

- Be careful to avoid substituting firm-level experience with the individuals who will actually be working with you. Both are important but different.

- These four aspects are hierarchical as are the people that have deep knowledge of each. Like all hierarchies, it is nearly impossible to "look up" and understand so many people may think they are working at the management or even strategy level when they are really working at the preparation level.

- Be careful of substituting a certification like CPA or Attorney for where someone is on this hierarchy.

- Be careful of mistaking you own lack of knowledge of the thousands of details that go into taxes with placing someone higher on the hierarchy than they should be.

- The people will change over time with changes to your business.

Understand the Process (and Timing):

- Like a good production tracking system, if you can't go to a whiteboard, sketch out a basic model, and do some simple calculations, then it is too complex.

- You do not have to understand every detail to understand the biggest drivers and expected outcomes.

- Keep looking for people who can take the complexity of the tax code and break it down into simpler metrics and rules-of-thumb that you can understand.

"If you can't explain it simply, you don't understand it well enough." - Einstein

Understand the Variables and Risks:

As an owner, you are taking on the majority of the risk so you should know the driving variables, risks, and probabilities.

Keep in mind that nearly all models built on increasing levels of complexity in financial instruments and regulations have fallen apart over time. This does not mean that you should not take advantage of them while they are available but know the risks.

For example, if your strategy was to use a C-Corp structure to save on taxes while building capital and to exit in a way that preserved that capital without double taxation, what is the impact if your business results, strategy, timing, or personal needs change, and you harvest some of the excess capital in the business? What is the impact of that as compared to a pass-through tax structure?

When calculating these, make sure you model them in both percentages and dollars. Depending on the context, 2% may be immaterial or it could be millions of dollars.

With our engagement model focused on long-term outcomes, we see these play out in many ways, especially during succession. Too frequently, the results are negative surprises, much like a project going over schedule and over budget. There are no perfect answers that we've found. With that said, we will freely share anything we've learned that will help you build a stronger business and "Retirement Masterpiece."

Please contact us to talk specifically about your situation.