Market Basics - Industry Sectors, Local Economies, and Project Owners

Due to the highly fragmented nature of the construction industry, the market's need for construction services is largely independent of the individual contracting businesses.

The need for construction services in any given geography or industry sector is driven by broader needs and all falling into a sequence:

- There is a broader demand for a core service. A historical example of that might be steel production in Pittsburg to support other industries.

- Certain geographies are preferable for locating that manufacturing, including access to the land required and transportation efficiency, which would be primarily rail and water for moving the inputs and outputs of steel manufacturing to and from the factory.

- The construction services required start with the facility for the manufacturing and infrastructure to support it, such as power, water, and communications.

- Additional infrastructure is required for transportation including roads, rail, and ports in the case of steel manufacturing.

- Additional people start to migrate into the area requiring housing and the support infrastructure for the housing including power, water, communications, and roads.

- Then follow-on services start being developed to further support the needs of the people. These include education, hospitals, fire, police, and other government services, along with all the infrastructure they require (power, water, communications, and roads).

- As the economy in the local area continues to grow, you will have the full range of places of worship, retail, restaurants, arts, and entertainment develop, along with the supporting infrastructure they require.

- For sustainability and growth of a local economy, it must continue to diversify beyond what created that core demand. That might, for example, require Houston developing core competencies in cancer research and treatment, which in itself starts attracting more people - back to #1 again.

The important thing to always pay attention to is what the underlying drivers of the local economy are even if you are not working directly for those project owners. For example, Detroit was driven by auto manufacturing, all other construction and maintenance services are downstream of that core industry. Your business might be in road building, healthcare, or hospitality. There may be latent demand for those services, so you could be very busy at a time when the underlying industry driving the local economy stops growing or even begins shrinking.

For a construction business to be sustainable and scalable, including through succession, the leadership must constantly be watching the market and placing bets that position them in markets that provide the best chances to win in the short, mid, and long-term. Those are your strategic market choices and strategic market experiments.

In the first few stages of growth, contractors are typically more reactive to the market and customers. This is absolutely normal. As contractors move past stage 4 of growth and/or work through ownership succession, the mindset about the market must shift.

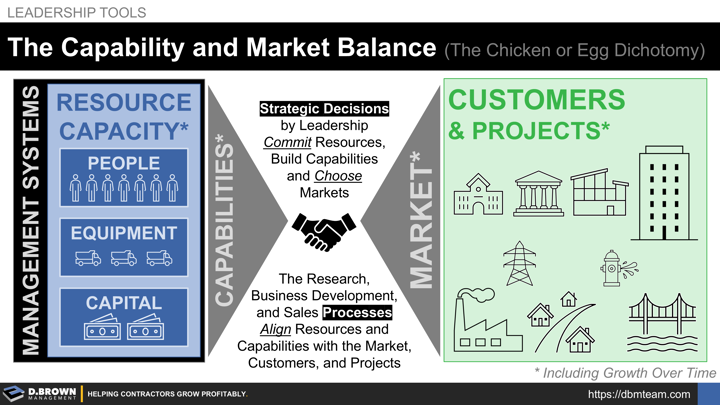

The Chicken and the Egg Dichotomy

- Contractors have a finite number of resources, including talent, equipment, and capital. Choosing to invest in expansion of capabilities and capacity is one the most significant decisions leaders will make.

- Build too much capacity for the available market and outcomes will be negatively impacted.

- Taking on too much work without having the right level of capabilities and capacity is one of the primary reasons for contractor failure.

- Competing for a very small percentage (< 20%) of the available work in a given market typically means much lower profit margins and poor cash flow. Ideally, you want to be one of the top three contractors in your strategic market choices or have a clear strategy and plan for getting there.

Strategic Decisions by leadership commit the resources required to build the capabilities and choose the markets to compete in.

The research, business development, and sales processes align resources and capabilities with the market, customers, and projects.

Self-Evaluation: Strategy & Business Development

- Do you have clear answers to these five interlinked questions that define your strategy?

- How do your business outcomes looking back over the last three years and looking forward to the next three years compare to industry benchmarks?

- Where are you currently at with the nine hurdles in business development and management effectiveness?

Please schedule some time if you want to confidentially talk through your answers and possible next steps. There are a lot of nuances to this self-evaluation. We will share freely anything we've learned that will help you build a stronger construction business.

All relationships start with a simple conversation - let's talk.